Wissenschaftliche Literatur Capital Structure

Eine Auswahl unserer Fachbücher

Falls bei Ihnen die Veröffentlichung der Dissertation, Habilitation oder Masterarbeit ansteht, kontaktieren Sie uns jederzeit gern.

Zum Shop

Zum ShopMarkus Hang

Firm Value Effects of CapitalStructure and Corporate Hedging Decisions

Empirical Evidence from Meta-Analyses and Electric Utility Firms

Im Zentrum dieser Untersuchung stehen die Beziehungen zwischen Kapitalstruktur-Entscheidungen, Hedging-Entscheidungen und Unternehmenswert. Obwohl die empirische Literatur im Bereich Corporate Finance rapide wächst, im Besonderen in der Forschung zur Kapitalstruktur und zum Hedging – was zu den zentralsten Themen der Corporate Finance-Forschung zählt – wird die Literatur in zunehmendem Maße unübersichtlich und in ihren Ergebnissen uneindeutig. Daher setzt es sich der…

Capital StructureCorporate FinanceCorporate HedgingEnergieversorgerFirm ValueKapitalstrukturMeta-AnalyseRisikomanagementUnternehmenswert Zum Shop

Zum ShopPhilipp Immenkötter

Essays on CapitalStructure Decisions:

Financial Flexibility, the Business Cycle, and Tax Benefits

This book provides an extensive analysis of how companies choose the mix of debt and equity to finance their assets. In three distinct essays, the author presents novel empirical and theoretical explanations for the dispersion of debt ratios of US firms within the last four decades. The first essay shows the importance of financial flexibility in capital issuance decisions, while the second analyzes the impact of macroeconomic risk on optimal capitalstructure choice. In…

Benefit to LeverageCapital StructureCorporate FinanceCredit RatingsFinancial FlexibilityLeverageMacroeconomic RiskRegime SwitchingTax BenefitsTax Shield

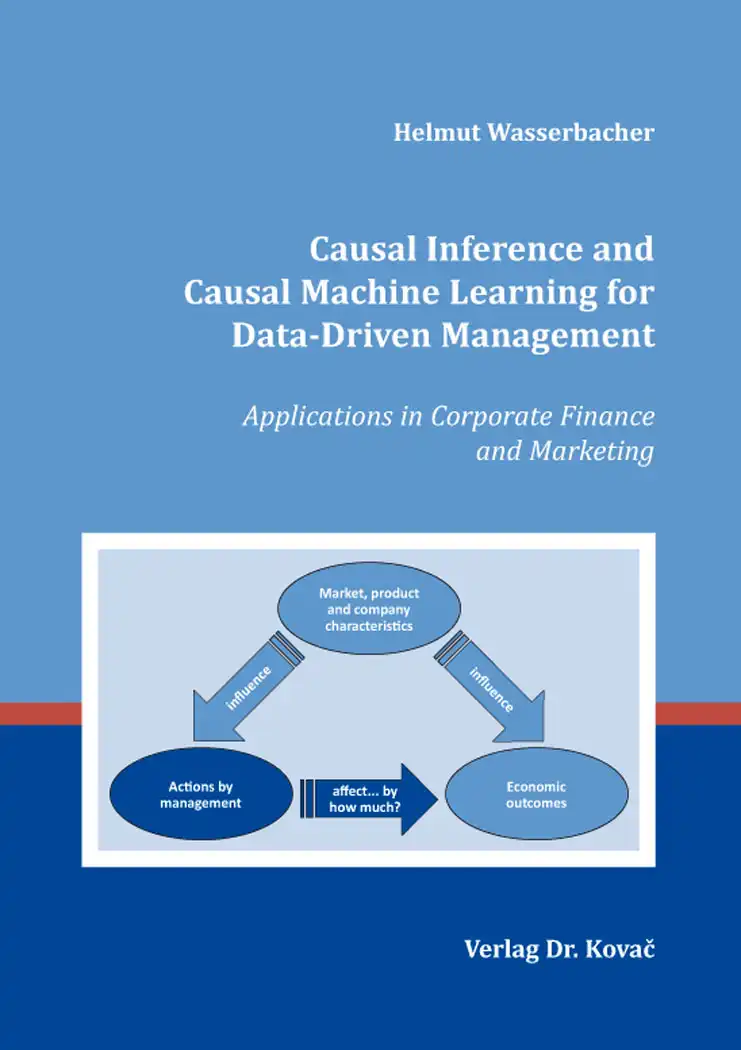

Helmut Wasserbacher

Causal Inference and Causal Machine Learning for Data-Driven Management

Applications in Corporate Finance and Marketing

Schriftenreihe innovative betriebswirtschaftliche Forschung und Praxis

The availability of large amounts of data, coupled with artificial intelligence and machine learning as suitable techniques to exploit them, has led to increasing interest in data-driven management. Data are turned into insights, and insights into management decisions.

In the midst of this passion for artificial intelligence, practitioners must remain aware that most machine learning methods maximize predictive performance. This is not the same as identifying…

Causal machine learningDigital marketingKapitalstrukturKIKünstliche IntelligenzMarketingMaschinelles LernenOmnichannel marketing Zum Shop

Zum ShopRüdiger Stucke

Financial Engineering and Structuring in Leveraged Buyouts

In a Leveraged Buyout, a Private Equity investor finances the purchase price of a company to a substantial fraction with debt in addition to the equity contribution out of his fund and from the participating management. The rationale for this financing structure is the substitution of equity, as an expensive source of capital, with comparably cheap debt in order to increase the expected returns on the individual equity investment and, thus, the returns of the whole fund.…

Financial EngineeringFremdkapitalfinanzierungFusionHeuschreckenInstitutionelle InvestorenInvestorenKapitalismusLeveraged BuyoutsM&AMergers & AcquisitionsPrivate EquityÜbernahmeValue Creation