Björn PlaschnickOn the Nature of Fundamental-based and Panic-based Bank Runs

An Analysis of the Origins of Bank Runs

Schriftenreihe volkswirtschaftliche Forschungsergebnisse, Band 160

Hamburg 2010, 176 Seiten

ISBN 978-3-8300-4955-5 (Print)

ISBN 978-3-339-04955-1 (eBook)

Zum Inhalt

In the last decades, bank runs appeared to be a relic of the past. The run incidents during the recent global financial crisis have however shown that the threat of bank runs has not vanished and still represents a severe problem for the stability and performance of modern economies‘ banking systems.

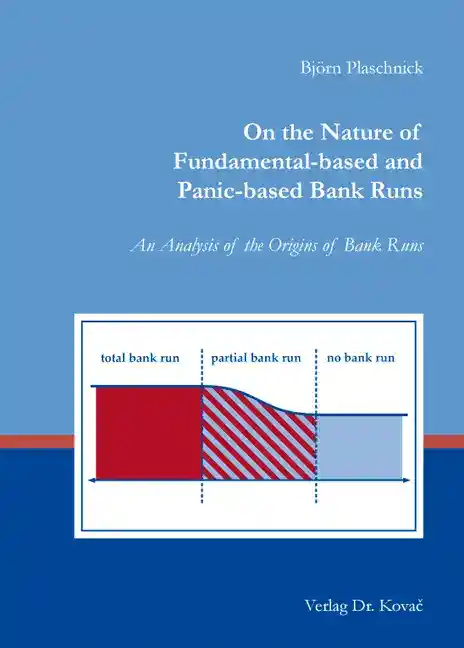

The causes of bank runs and their economic consequences are the subject of this book. A theoretical model of an economy‘s banking sector is developed in which bank runs occur due to bad news about future investment returns of banks as well as due to a panic behaviour of depositors, i.e. fears of massive withdrawals by the other depositors. The determinants for the emergence of runs are examined. Furthermore, the economic consequences of bank runs, as well as the effects of measures for their prevention are analyzed.